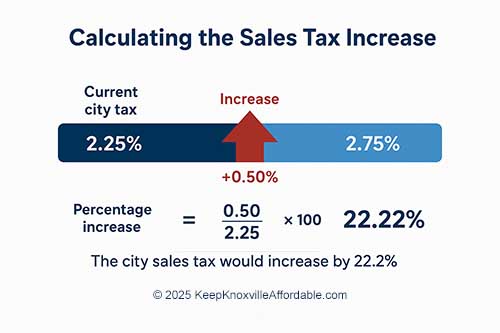

The combined sales tax is 9.25%, which includes 7% state tax and 2.25% local option sales tax.

- Current local rate: 2.25%

- Proposed local rate: 2.75%

- Difference: 0.5 percentage points

- A 22.22% increase in the local option sales tax.

They say, “It’s only a 1/2 cent increase in the tax.”

The facts: It’s a 22.22% increase in the local option sales tax.

Run from their spin.

We have the receipts:

The tax is just one of many costs residents face. Combined with property tax increases, hotel/motel taxes, red light & speed cameras everywhere, increased parking fees, new “art” sculptures, and likely future tax hikes, it represents “death by 1,000 taxes,” and an increase in the cost of diapers, medication (Tylenol, Tums, Cough/Cold Meds, Allergy Meds), feminine hygiene products, toilet paper, make-up, and it hurts those on fixed income.

The City budget has stretched resources, and spending priorities have not been managed responsibly. Critics argue the City has overspent or allocated funds wastefully on non-essential projects like the millions spent on an Alien mushroom “art” sculpture, a bridge to nowhere, $11 million on a swimming platform, instead of funding the Gay Street Bridge or pothole repair. Now, instead of reducing unnecessary spending, they are asking residents to pay more through a tax increase.

- Everyone who shops in Knoxville, residents and non-residents, pays the higher rate at checkout.

- Seniors and retirees on fixed incomes feel it more because their incomes don’t rise with prices.

- Low and middle income households are hit hardest (sales tax is regressive, taking a larger share of smaller incomes).

- Families with kids buying everyday items (e.g., diapers, clothing, school supplies).

- Students and renters with tighter monthly budgets.

Bottom line: Everyone pays more, and for those already on the edge, this is the hit that will break the budget.

Yes.

- The City could reallocate funds

- Cut non-essential spending

- Pursue grants

- Prioritize essential projects without raising taxes.An example: the City wants to raise the sales tax to fund new greenspaces. Greenspaces are the largest proposed allocation in their plan at $50,000,000. Not Infrasturture. Not Roads. Knoxville already has nearly 100 parks.

You must register to vote and vote AGAINST in the November 2025 election. This is the way.

No Guarantees. The Mayor just last week stated on video that the money is not guaranteed or promised to go into any of the buckets the City is proposing to fund. This should be noted as a solid red flag for residents.

Yes. Property taxes have already risen under this City Council and are likely to increase again, adding to residents’ financial burden. Evidence shows the City Council raised fees on red light cameras, parking, and other services. Property taxes are most likely to rise again regardless of whether this sales tax passes.

Yes. Seniors spend a higher percentage of their income on taxable goods and services, so the increase hits them hardest. The City did not exempt taxing seniors nor fixed income residents the additional proposed sales tax.

Yes. You’re affected too. Every time you shop in Knoxville, you’ll pay the extra 22.22% increase in the city’s local-option sales tax.

Think about it: Many people come here because Knoxville is more affordable than surrounding areas. That affordability takes a hit when essentials like clothing, medicine, vehicles, and household items suddenly cost more at the register.

That’s why it matters: even if you don’t live in Knoxville, the higher tax follows you whenever you shop here.

Share this page with your Knoxville friends and business associates so they know what’s really at stake.

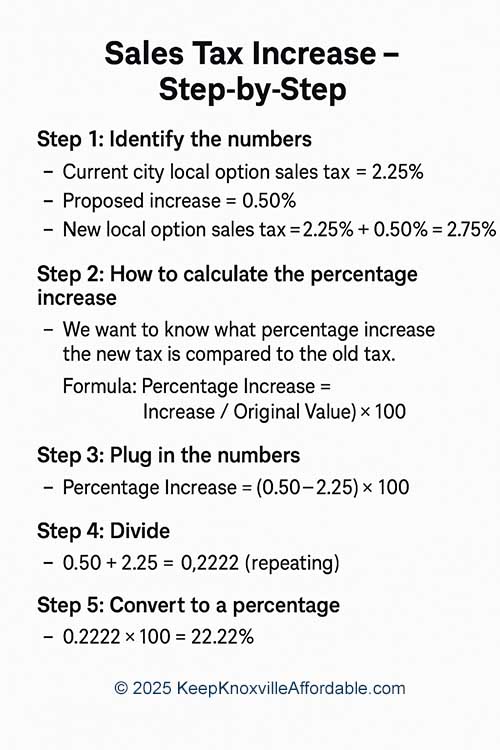

The City refers to it as a “½ cent increase” because the rate rises by 0.5 cents on each taxable dollar (from 2.25¢ to 2.75¢). However, that language can be misleading. In reality, this is a 22.22% increase in the local option sales tax. Don’t be tricked, this tax is not just on one item. Add this 22.22% increase to almost every single item you purchase, including medication. To understand the percentage increase in the city’s sales tax rate:

Percentage Increase = (Increase ÷ Original Rate) × 100

Percentage Increase = (0.5 ÷ 2.25) × 100 = 22.22%

This means the city’s local option sales tax rate would increase by 22.22%.

The increase adds to Knoxville’s growing stack of taxes & fees, hitting families and seniors repeatedly, with no guarantees of benefits.

The 22% local tax increase is significant. Voting in November is the only way to stop it and prevent more financial strain on residents.